By James D. Wilton

•

May 28, 2025

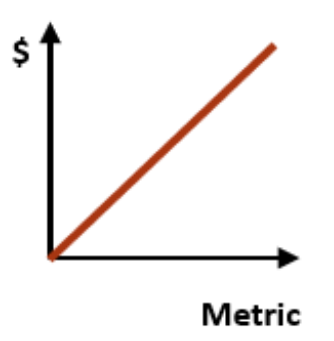

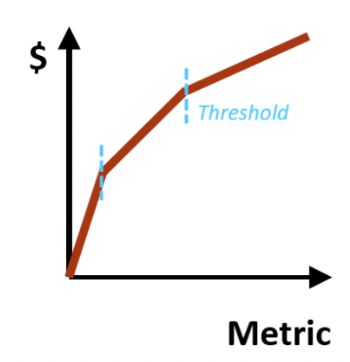

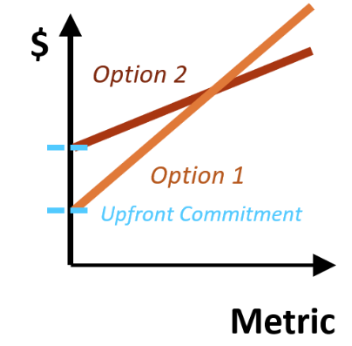

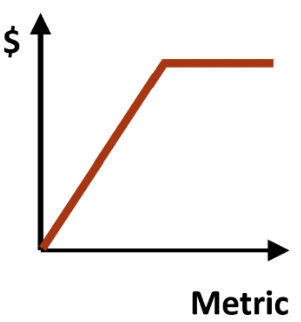

Outcome-based pricing (OBP) is one of the hottest topics in AI and SaaS monetization today. Instead of charging customers for access or usage, vendors charge based on measurable results. The idea? Customers only pay when they see real value. It sounds like the ultimate pricing model - perfectly aligned incentives, no wasted spend, and a direct link between cost and benefit. So why don’t more companies use it? Because in reality, OBP is much harder to execute than it looks. It’s been around for decades, but few companies truly succeed with it. That’s because OBP introduces complexity, risk, and friction that can make it more challenging than traditional SaaS models. Here are the five biggest pitfalls of OBP - and what to do about them. 1. Defining the Right Metric is Harder Than It Looks The biggest challenge in OBP is choosing a metric that accurately reflects value - without creating unintended consequences. If the vendor defines success too loosely, customers will feel overcharged. If the metric is too restrictive, vendors won’t get paid fairly. Example: Zendesk’s AI Ticket Resolution Pricing Zendesk introduced AI-powered customer service pricing based on resolved tickets. But customers pushed back - because Zendesk’s definition of a "resolution" didn’t always match what customers considered a real resolution. The lesson? A pricing metric must be: Meaningful to the customer (aligned with their definition of success). Tied to the vendor’s real value-add (not just surface-level activity). Difficult to game or manipulate (or customers will optimize against it). 2. Attribution is a Nightmare (Even with AI) Choosing the right metric is only part of the battle - there’s still another problem: Can you prove that YOUR product drove the result? In many cases, multiple factors contribute to an outcome. If revenue grows, was it because of the AI-powered sales tool, better sales reps, or an overall market uptick? Example: IBM Watson & Salesforce Einstein Both were positioned as transformational AI platforms, but customers struggled to isolate the AI’s impact. They could see business improvements, but couldn’t confidently say, “Watson/Einstein was responsible for X% of that success.” Notably, neither IBM nor Salesforce uses OBP for these products. Why? Attribution is too difficult. If vendors can’t prove they caused the outcome, customers won’t want to pay for it. A better approach: Control more of the process (the more your product influences the outcome, the easier it is to claim credit). Use proxy metrics (if direct attribution is hard, find leading indicators that correlate with success). Offer hybrid pricing (mix base fees with OBP so revenue isn’t fully dependent on attribution). 3. Baselining Gets Messy, Fast Even if a vendor picks the right metric AND can prove attribution, there’s yet another challenge: How do you measure improvement? The problem: Many OBP models assume a static baseline - but in reality, customer environments change over time. Example: Fraud Prevention in Financial Services Some AI vendors charge based on the reduction in fraudulent transactions. But this raises tough questions: What’s the starting fraud rate? (Pre-existing fraud levels may fluctuate.) Should the baseline reset each year? (If the vendor permanently reduces fraud, do they still get paid for maintaining it?) The lesson? Customers won’t want to pay for improvements they believe they would have achieved anyway. And vendors need a way to continuously justify their impact. A better approach: Define clear baseline periods (e.g. compare against the 6 months before implementation). Adjust pricing over time (the vendor’s impact might be front-loaded, requiring a different model in later years). Use tiered pricing (higher fees early, lower fees as impact normalizes). 4. Revenue Delays Can Kill a Vendor Even if everything else works - the metric is solid, attribution is clear, and baselining is fair - there’s still one big problem: Vendors often don’t get paid until months (or even years) after delivering value. This creates massive cash flow risks. Many SaaS companies depend on predictable, upfront revenue to fund operations. But OBP means revenue recognition is delayed, making forecasting difficult. Example: Riskified’s Outcome-Based Model Riskified, a fraud prevention platform, only gets paid when transactions are successfully approved without fraud. This aligns incentives - but it also means their revenue is inherently unpredictable. The lesson? While this approach works for Riskified, not every vendor can afford to wait for long-term verification before getting paid. (Note: Investors may not love it either - Riskified trades at just 1.89x EV/Revenue, a very low multiple for a SaaS company.) A better approach: Charge a mix of fixed fees + OBP to ensure steady cash flow. Offer performance tiers (higher base fees for lower-risk customers, full OBP for riskier bets). Use milestone-based payments - instead of waiting for full verification, charge in phases. 5. Customers Prefer Predictability - Even Over Potential Savings Even if an OBP model delivers better value, many customers still choose predictable pricing over variable costs. Why? Most businesses prefer stable, budgetable expenses over a fluctuating fee - even if the predictable price is technically more expensive. Example: Conversational AI in Customer Support A vendor offering an AI chatbot asked customers to choose between: Payment based on how many conversations the AI fully handled (OBP model). A flat subscription fee. Most customers chose the flat subscription. The lesson? Even if OBP is theoretically the best model, buyers often prefer predictability. The existence of an OBP option, however, can signal vendor confidence and reinforce the value of a fixed-price plan. A better approach: Give customers a choice (some will prefer OBP, but many want predictability). Use OBP as an anchor (show the OBP price, but steer customers toward a fixed option). Cap OBP costs to reduce buyer anxiety. Final Thoughts: OBP Works - But It’s Not for Everyone Outcome-based pricing sounds great in theory, but it’s tough to get right. When structured poorly, it leads to: Customer friction (over unclear metrics or unfair pricing). Revenue instability (due to attribution and baseline issues). Delayed payments (which can crush cash flow). The best OBP models: Pick the right metric - aligned to value and hard to manipulate. Solve the attribution problem - proving the vendor’s role in success. Balance cash flow - with a mix of fixed fees and variable components. OBP isn’t broken - but it’s not a magic bullet. Companies that embrace it need to go in with open eyes and a clear strategy. What’s your take? Have you seen OBP succeed or fail? Let’s discuss.