Maximizing Value, Minimizing Complexity: The Role of Implicit Pricing Metrics

Implicit price metrics and fences may be the most underutilized tools in optimizing B2B SaaS pricing strategies. Whether due to misguided concerns around pricing transparency, justification, or ethics, many businesses have chosen not to take advantage of structured, implicit price differentiation – and have instead just accepted the resulting value leakage.

What is an implicit price metric?

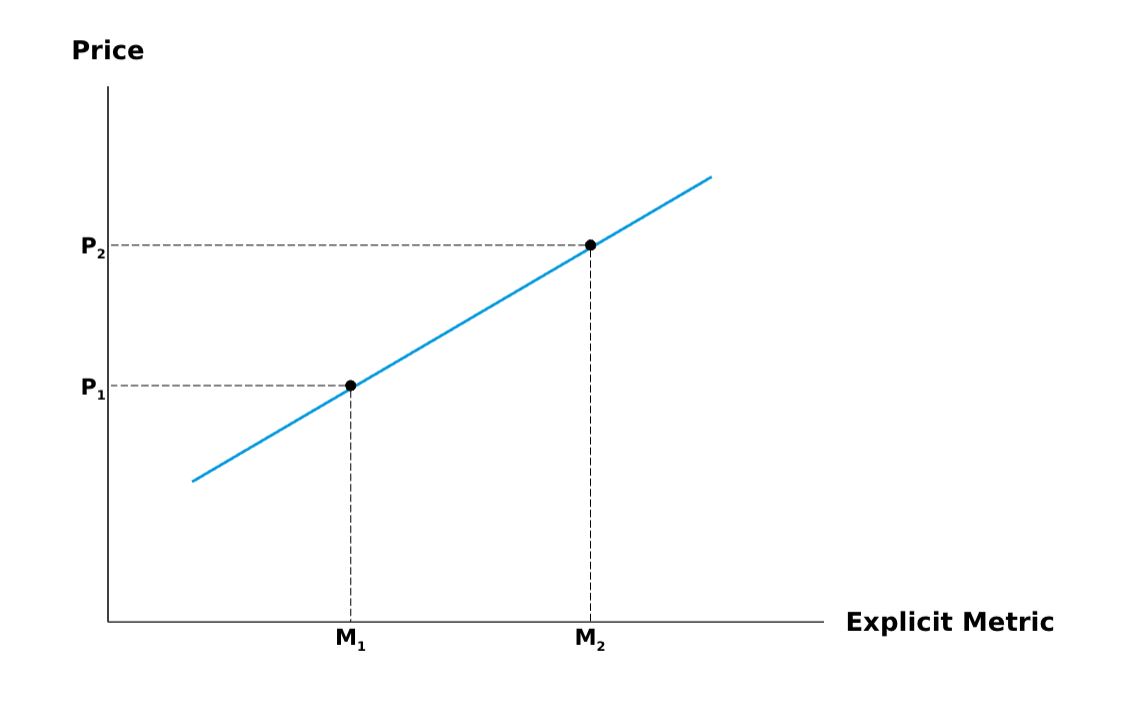

SaaS leaders are likely more than familiar with explicit price metrics – these are the customer-facing units used to scale a software’s price. They are out in the open for all to see.

Implicit metrics (and fences) are used behind the scenes to adjust the price per unit of an explicit metric. The implicit metric is not explained to the customer – the work of the implicit metric is to change the price list that the customer does see.

Typically, implicit metrics or fences are aligned to factors that impact a customer’s received value and willingness to pay – but do not align with how the vendor wants to communicate their platform’s value.

Implicit price differentiation is particularly valuable in enterprise SaaS pricing where, due to the lower volume and higher value of deals, optimizing each customer’s price is critical – but explaining the complex multi-metric system to arrive at that price might disrupt the sales process.

Why use implicit price differentiation?

Your lead-gen software company has landed on a great explicit price metric: number of leads. It’s aligned to value, acceptable to customers, and growth-oriented. What’s not to love?

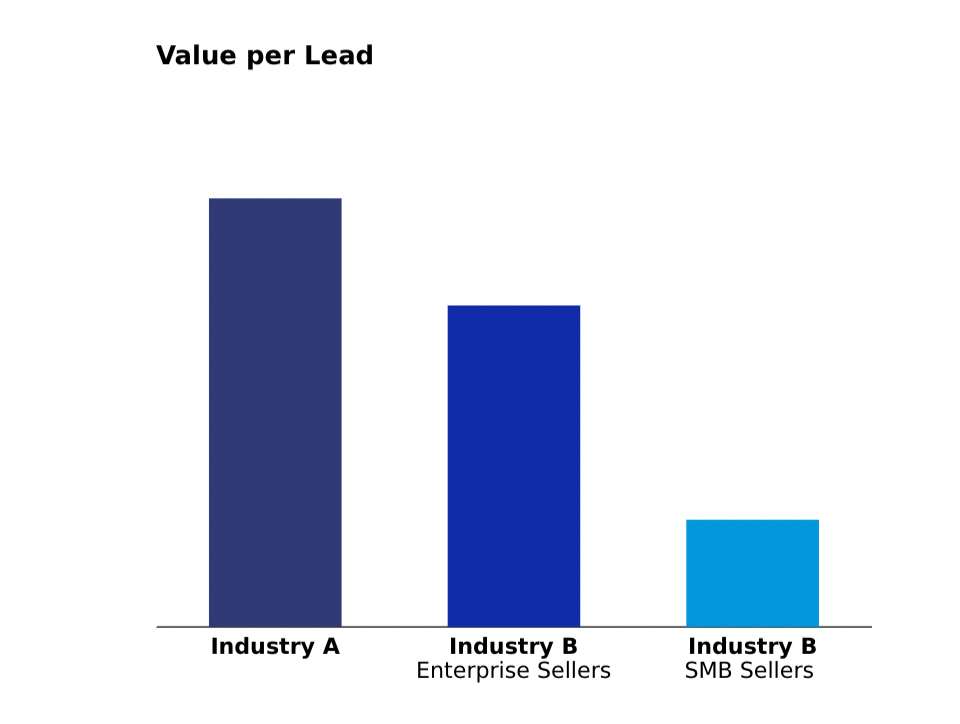

Well, your CRO points out that you sell in two different industries. Industry A has a high end-customer ACV while Industry B’s end-customer ACV is much lower. Then, an insightful Account Executive points out that within Industry B, most customers sell exclusively to either SMBs or Enterprises.

It’s clear that these different customer types are going to receive a different amount of value per lead and likely have very different budgets. Of course, one option is to have a standard price per lead curve. Unfortunately, this is likely to result in one of three sub-optimal outcomes:

- Price levels will be set to accommodate customers with low willingness to pay – under-monetizing a set of customers.

- Price levels will be set to the highest level of willingness to pay – pricing out a share of prospective customers.

- Price levels will be set to accommodate the “average” customer – under-monetizing some customers, and pricing out others.

The optimal solution here is using an implicit price fence to differentiate the price per lead based on industry and end-customer ACV.

In utilizing implicit price differentiation, your business can fully monetize the high willingness-to-pay customers of Industry A while still serving the lower willingness to pay customers in Industry B. Additionally, sales reps will avoid the customer confusion and potential friction generated by delving into the details of your nuanced pricing strategy.

Are implicit metrics risky or unethical?

At Monevate, when we recommend that our clients’ price structure include implicit metrics, we often receive two questions:

Is it wrong or unethical to use implicit metrics and fences in a pricing structure?

An implicit metric provides a system of price differentiation – charging different prices to different customers. There are situations where price differentiation can be used illegally (e.g. to disadvantage protected groups, or to create anti-competitive situations) but in the vast majority of cases, price differentiation is fully legal.

At Monevate we would argue it is also wholly ethical, providing that you are using price differentiation to represent variance in the amount of value received by different customers – think smaller companies receiving lower prices than large companies so they can afford them.

Most companies price differentiate in some way.

Implicit price metrics are essentially just another method of price differentiation. The concern that they might be unethical likely comes from the perception that they are hidden.

It’s fairer to say that implicit metrics are “not proactively communicated” than “hidden.” You omit them from messaging because it would needlessly complicate the discussion, but you should be prepared to explain them if asked.

The fact that they are almost always “direct” metrics also contributes to the perception. Customers don’t choose their end-customer industry in the same way they choose a number of users. You are forcing the customer into a price point. However, that is true for many commonly used explicit metrics too. For example, many usage-based metrics monetize end-user usage (i.e. the usage of the customer’s customers) over which the customer has no control.

What happens when Customer A asks why Customer B is getting a lower price? (e.g. a buyer from Customer B moves to a role with Customer A)?

Customers do talk, and so you can’t rule out the possibility that one customer will find out that they received a higher price per unit than another customer. Therefore, it’s important to understand that implicit metrics must be defensible and sales reps must be ready to defend them. If challenged on price variances, account owners should be well-prepared to explain that the variance is driven by an implicit metric and why that implicit metric drives a value difference for customers.

The irony of concerns around implicit price differentiation is that most SaaS businesses are doing this today (e.g., discounting based on a customer’s budget), but elect to do so through unstructured, transactional discounting often based on sales rep’s perceptions of value and willingness-to-pay differences, which are far more likely to result in unfair price differentiation for the customer, and value leakage for the vendor

How does my business start to use implicit price metrics?

Implicit metrics or fences are not a necessity for every product or every business, but if there is a particular customer type where your business is consistently losing deals on price or discounting heavily to win – it might be time to explore adding implicit differentiation within your pricing structure.

1. Identify the customer attributes that drive differences in value or willingness to pay

This is best done through external customer research, but customer-facing team members may be able to provide insight into what these attributes are as well.

2. Determine which attributes are not already “solved for” within your packaging system or explicit metrics

For example, if larger team size and higher sales volume are both drivers of willingness-to-pay, but your Premium package includes features designed for a large team, only sales volume would be valuable as an implicit metric.

3. Establish the system for using the implicit price metrics within your price structure

Whether as a separate price curve for one implicit price fence, or a calculator that accounts for multiple metrics, specific price levels should exist for each explicit and implicit metric or fence combination.

For a deeper dive on implicit metrics and how to determine the optimal price metric for your business, watch our full masterclass on exactly this topic. Simply, join The Cube (THE premiere pricing community) to gain free and instant access to this and all previous recordings, slides, transcripts, and tactical resources.